Find out what are the best Malaysian Private Retirement Schemes PRS to invest in in 20202021. AIA PAM Moderate Fund.

Private Retirement Scheme Prs Public Mutual Berhad

AIA Private Retirement Scheme.

. We Offer Over 60 Funds With 4 5 Star Ratings From MorningStar. AIA Pension and Asset Management Sdn Bhd. AIA PAM Conservative Fund.

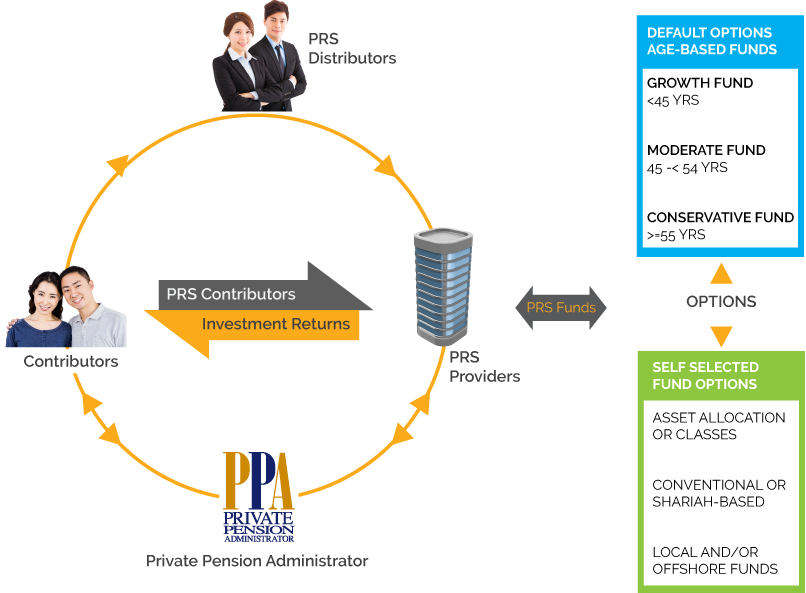

Private Retirement Schemes PRS is a voluntary long-term savings and investment scheme designed to help you save more for your retirement. Private Retirement Scheme PRS Private Retirement Scheme PRS is an investment scheme that facilitates the accumulation of retirement savings through voluntary contributions. The Mechanism of Private Retirement Scheme Malaysia As the name implies PRS is privately managed by asset management companies also known as PRS providers.

AIA PAM Growth Fund. For public employees there is the Kumpulan Wang Persaraan Diperbadankan or KWAP Malaysia which focuses on managing retirement and pension funds for civil servants. Currently only Class A is available for subscription through PPA PRS Online.

Housing purposes From sub-account B. PRS seek to enhance choices available for. Permanent departure from Malaysia.

Ad Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment. Save invest and retire wellPrivate Retirement Schemes Quick Overview. Ad Get a Diversified Portfolio for your Retirement Goalsin One Simple Investment.

We Offer Over 60 Funds With 4 5 Star Ratings From MorningStar. The Private Retirement Schemes are offered by PRS Providers who are approved by. Which PRS Fund to pick.

The sheer amount of funds that we should have by the time we retire can be an overwhelming sum. Private Retirement Scheme known as PRS for short is a long-term savings plan which allows you to voluntarily contribute and build up your retirement fund. For more information on Class C and Class X you may contact Principal Asset Management Berhads.

You can make pre-retirement withdrawal for the following purposes without 8 tax penalty4. Private Pension Administrator Malaysia PPA is the Central Administrator for the Private Retirement Schemes PRS. FAQs Which PRS in Malaysia is the Best.

What is PRS Introduction to Private Retirement Scheme in Malaysia skip this part if youre. This was shown in my article on Retirement Planning in Malaysia. List of PRS Providers Private Pension Administrator Malaysia PPA A Quick Introduction to PRS Providers.

Prs Fees Comparison Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa

A Complete Guide To Prs Malaysia Private Retirement Scheme Youtube

Private Retirement Scheme In Malaysia Dividend Magic

Which Prs Funds To Invest In 2020 2021 Mypf My

Aminvest Private Retirement Scheme

A Complete Guide To Epf Members Investment Scheme Best I Invest Fund Youtube In 2022 Investing Financial Literacy Fund

Private Retirement Scheme Principal Asset Management

3 Places To Get Prs In Malaysia With Zero Sales Charge Ringgit Oh Ringgit

Aminvest Private Retirement Scheme

Prs For Self Employed Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa

Structure Of Prs Private Pension Administrator Malaysia Ppa

3 Reasons Why You Should Invest In Prs Private Retirement Scheme Malaysia Retirement Youtube

Pin On Financial Freedom And Personal Finance Malaysia